Portfolio Optimisation Inside Out

Main points:

- Usually in portfolio optimization the utility is primary and constraints secondary

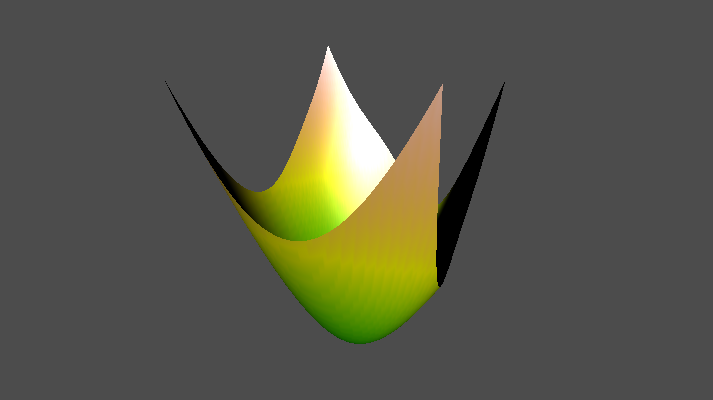

- We get a useful point of view if we put constraints primary and utility secondary

- random portfolios give us this point of view

- one way of generating random portfolios is outlined

- constraining fractions of portfolio variance per asset is a good alternative to weight constraints

Presented 2011 December at the Computational and Financial Econometrics conference.