Performance Measurement via Random Portfolios

by Patrick Burns.

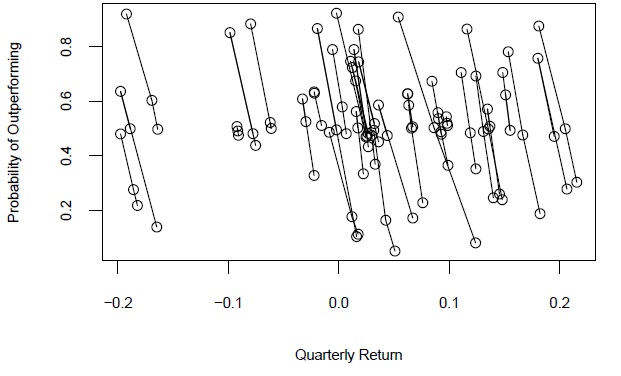

Abstract: Problems with performance measurement using information ratios relative to a benchmark are exposed. Random portfolios (that obey constraints but disregard utility) are shown to measure investment skill effectively. Investment mandates can also be based on random portfolios — this allows active fund managers more freedom to implement their ideas, and provides the investor more flexibility to gain utility. The issue of the proper attitude towards tracking error is broached, but left largely undecided. There is also a critique of Fisher’s method of combining p-values that shows Stouffer’s method to be preferable.

This version: 2004 December 02 (pdf)

A revised version of this with some additional material appears as “Random Portfolios for Performance Measurement” in Optimisation, Econometric and Financial Analysis E. Kontoghiorghes and C. Gatu, editors. Springer.