Random Portfolios for Evaluating Trading Strategies

by Patrick Burns.

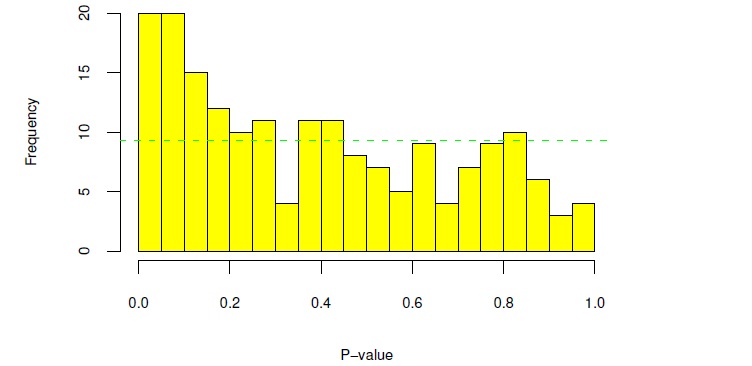

Abstract: Random portfolios can provide a statistical test that a trading strategy performs better than chance. Each run of the strategy is compared to a number of matching random runs that are known to have zero skill. Importantly, this type of backtest shows periods of time when the strategy works and when it doesn’t. Live portfolios can be monitored in this way as well. This allows informed decisions — such as changes in leverage — to be made in real-time.